On Monday, the EUR/USD currency pair continued to trade lower—what else could it do? This situation reminds us of last year when we frequently noted that the euro was overbought and unjustifiably expensive. While predicting the exact timing of a new trend is always challenging, we cautioned that it might begin after September 18. The trend ultimately started on September 25, so the current decline of the euro does not come as a surprise to us. We've been discussing this scenario throughout 2024. It's important to recognize that prices can change direction regardless of the presence or absence of fundamental or macroeconomic factors; we refer specifically to local influences. When a clear trend is visible to all market participants, why would anyone choose to buy an asset that is consistently losing value?

It's important to remember that a currency pair's exchange rate is determined solely by supply and demand, rather than by macroeconomic reports or Federal Reserve speeches. The market forms a long-term opinion that aligns with the prevailing trend, based on global fundamental factors such as Fed monetary policy, economic crises, and geopolitical conflicts. This opinion influences trading and leads to long-term trends. Although local events and reports can affect trader sentiment over the course of a single day, they do not dictate the overall trend.

Currently, the euro may continue its decline against the dollar. While we cannot predict the exact level at which the pair will stabilize, there is no indication that the current trend is concluding. Looking at the weekly timeframe, it appears likely that the euro could drop below $0.95, potentially even lower. Although this possibility may seem hard to believe to some, just a few months ago, few anticipated a drop of 1,000 pips, and no analysts predicted a fall to parity.

The target zone we have mentioned several times has now been reached. The price has entered the range between 1.0000 and 1.0200, which we identified as the objective. Notably, no significant news was required for the euro to continue its decline on Monday. In the near future, a new upward correction may begin, but trading during corrections is generally not advisable. While we won't discourage anyone from attempting it, as long as the trend remains— even on the daily timeframe—considering long positions is not logical. This week, only the U.S. inflation report has the potential to bolster the euro. However, it's important to remember that no one can predict when market makers will start locking in profits on their short positions or how far they'll allow those positions to run.

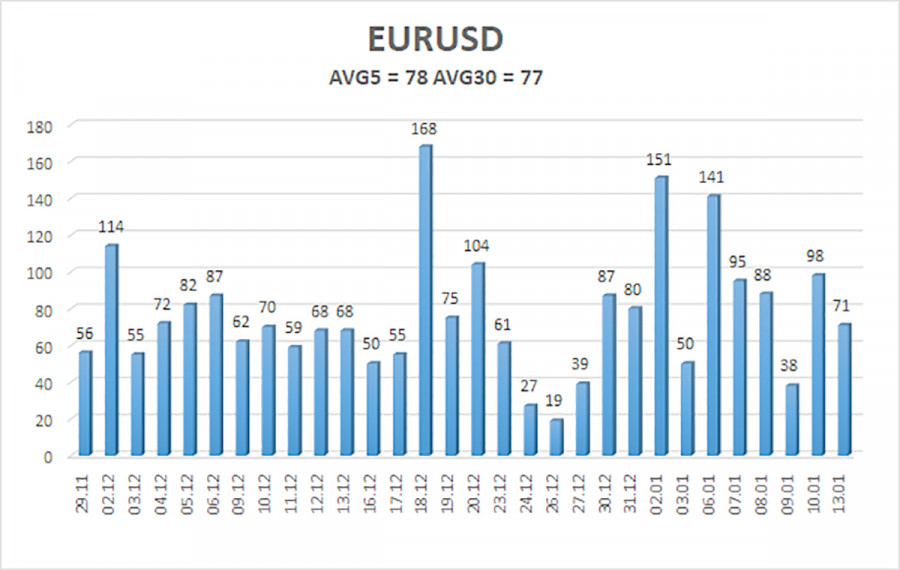

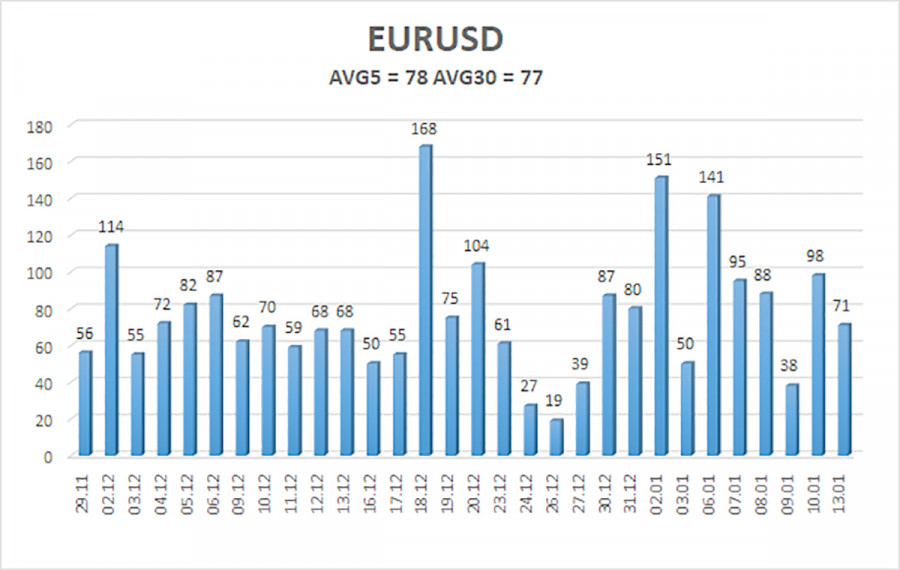

The average volatility of the EUR/USD currency pair over the last five trading days as of January 14 is 78 pips, which is classified as "average." On Tuesday, we anticipate that the pair will move between the levels of 1.0136 and 1.0292. The higher linear regression channel remains downward, indicating a continuation of the global downtrend. Recently, the CCI indicator entered the oversold zone twice and formed two bullish divergences; however, these signals only suggest a potential correction.

Nearest Support Levels

Nearest Resistance Levels

- R1: 1.0254

- R2: 1.0315

- R3: 1.0376

Trading Recommendations:

The EUR/USD pair is likely to continue its downtrend. In recent months, we have emphasized the expectation of further declines in the euro in the medium term. We firmly support the overall bearish direction and do not believe that this trend has ended. There is a significant likelihood that the market has already priced in all future Fed rate cuts. As a result, the dollar currently lacks medium-term reasons for a decline, apart from purely technical corrections.

Short positions remain relevant, with targets at 1.0193 and 1.0136. For those trading based purely on technical analysis, long positions can be considered if the price moves above the moving average, targeting 1.0437. However, any upward movement should be classified at this moment as a correction.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.