A new round of confrontation is beginning between Donald Trump and Elon Musk, one that could potentially "blow up" all of America. At this point, it's incredibly difficult to find a person or country with whom Trump hasn't had a conflict. If he hasn't clashed with someone yet, it likely means he hasn't had time.

The U.S. House of Representatives has approved Trump's bill to cut taxes, increase spending on defense and immigration services, and reduce funding for medical programs for low-income citizens. This bill includes raising the U.S. national debt ceiling by... $5 trillion. Let me remind you, Trump came to office with promises to reduce the national debt.

Elon Musk, a frequent guest at the White House in the past, has been under siege for several months now. He opposes Trump's bill (for reasons that are, frankly, quite interesting – author's note) and has threatened all members of Congress who support it with election defeat next year. "Even if it's the last thing I do on Earth, I won't let those who vote for increasing the national debt win re-election," Musk wrote on X.

Musk also announced his intention to form a third political party in the U.S. to truly compete with both Democrats and Republicans, thereby giving Americans a broader range of political choices. Notably, Musk's popularity in the U.S. and worldwide may genuinely lead to voters shifting to his side. Many countries, especially those impacted by Trump's protectionist policies, may actively support Musk.

In my opinion, the conflict between Musk and Trump indicates a serious crisis in the U.S. political system. Musk is no longer just a businessman interested only in money—he has enough for ten lifetimes. But with his capital, he can indeed create a powerful political force, with serious support not just in America, but globally.

For example, the IT sector, young voters, and entrepreneurs are more likely to support Musk than Trump or any Democrat. If it truly comes to forming an "American Party," a major split may occur within the Republican Party, potentially leading to a significant decline in support for Trump within his own ranks, and even impeachment. Let me remind you, all past impeachment attempts failed because Republicans had enough votes in both chambers to block initiatives to remove the president and their leader.

From a legal standpoint, Musk has the right to form his own party. And if Trump applies pressure to companies like Tesla, SpaceX, or Neuralink—or Musk personally—it will appear to the public like a digital dictatorship. Some political analysts are even suggesting a revolution in the U.S. is not out of the question. Such prospects are unlikely to support demand for the dollar.

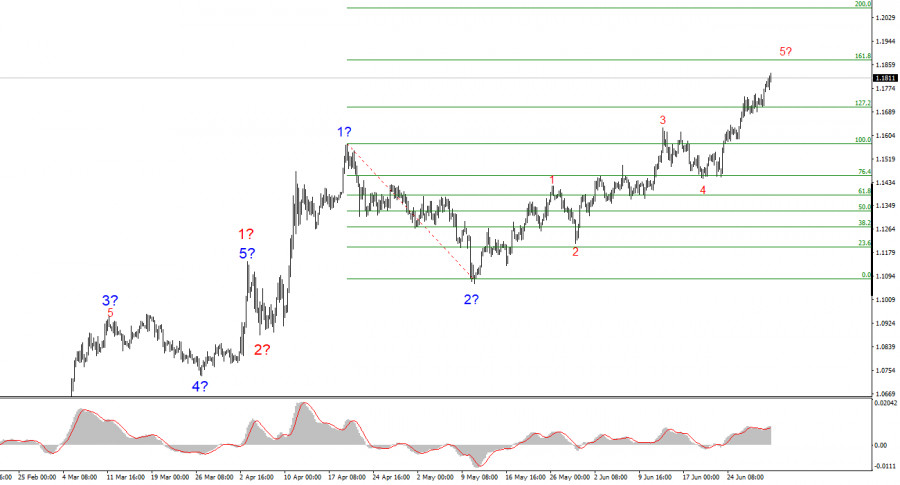

Wave Structure for EUR/USD:

Based on the analysis of EUR/USD, I conclude that the instrument continues to build an upward wave structure. The wave marking still entirely depends on the news background related to Trump's decisions and U.S. foreign policy, with no positive changes so far. The targets for wave 3 may extend to the 1.25 level. Therefore, I continue to consider buying positions with targets around 1.1875, corresponding to the 161.8% Fibonacci level. A de-escalation of the trade war is capable of reversing the upward trend downwards, but there are currently no signs of a reversal or de-escalation.

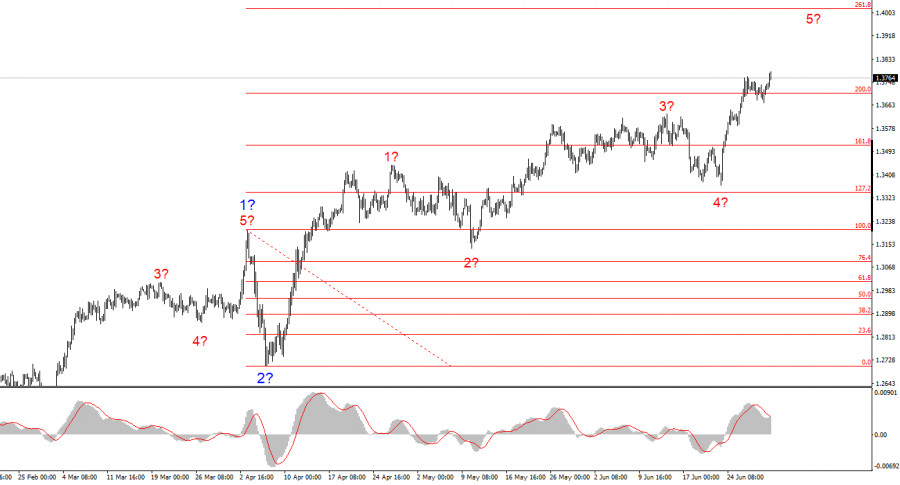

Wave Structure for GBP/USD:

The wave structure of GBP/USD remains unchanged. We are dealing with an upward impulse segment of the trend. Under Trump, the markets may experience a significant number of shocks and reversals that could seriously affect the wave pattern, but at this time, the working scenario remains intact. Trump continues to take actions that drive demand for the dollar lower. The targets for wave 3 are now around 1.4017, corresponding to 261.8% of the Fibonacci level from the presumed global wave 2. Therefore, I continue to consider buying positions, as the market shows no intention of reversing the trend.

Key Principles of My Analysis:

- Wave structures should be simple and clear. Complex structures are hard to trade and often change.

- If you're uncertain about the market situation, it's better not to enter.

- There can never be 100% certainty about market direction. Always use Stop Loss protection orders.

- Wave analysis can be combined with other forms of analysis and trading strategies.