The EUR/USD currency pair remained within a narrow range on Monday. There wasn't much news that day, and the few reports that did emerge failed to significantly interest traders. In simple terms, the market is waiting for truly impactful reports and events related to Donald Trump, not for German inflation or retail sales figures.

It is worth noting that both types of events are anticipated this week. Trump changed his mind about signing a deal with Iran, as he now lacks leverage. The U.S. President once again declared that Iran's nuclear facilities had been completely destroyed, and the agreement was supposed to involve Iran voluntarily abandoning its nuclear program. Since the program is allegedly no longer in existence, there's supposedly nothing to negotiate. From our perspective, the conflict between Iran and Israel cannot be considered over, but tensions have eased for now — something that doesn't benefit the dollar, which previously took advantage of Middle Eastern geopolitical tensions at least a few times.

However, this minor benefit did nothing to help the U.S. currency. The market quickly remembered that the U.S. dollar is no longer seen as a "safe-haven asset." It's actively losing its status as the "global reserve currency." Many central banks are starting to shift their dollar reserves into other currencies. Of course, this is a long-term process that may take years or decades, and a complete abandonment of the dollar is unlikely. However, while the dollar made up around 70% of global reserves in 2024, it's now down to 68%, and by the end of the year, it may drop to 65% or lower. Big things often start small.

By the way, Trump has already warned the world not to abandon the U.S. dollar as a means of payment or a reserve asset. Anyone who misbehaves will face punishment in the form of sanctions and tariffs. But who is truly afraid of tariffs and sanctions anymore? Essentially, Trump's ultimatums haven't frightened anyone. Negotiations with him are inevitable, of course, but from the dollar's standpoint, these talks offer little upside.

There was once hope that trade negotiations would lead to trade deals and, in turn, to the lifting of tariffs and an end to the global trade war. But as of July 1, it's clear that all trade deals will still include import tariffs — just in a more "softened" form. For example, the latest reports about the deal with China mention 55% tariffs on Chinese imports. So tell us — what's the point of a trade deal and "punishing" China if the tariffs remain in place and Americans end up footing the bill?

Therefore, just as there were no reasons for the dollar to rise before, there still aren't any now. Trump continues to aim to boost exports and balance trade. The Republican president wants to cut spending and raise revenue — but these changes impact Americans themselves, not Europeans or the Chinese.

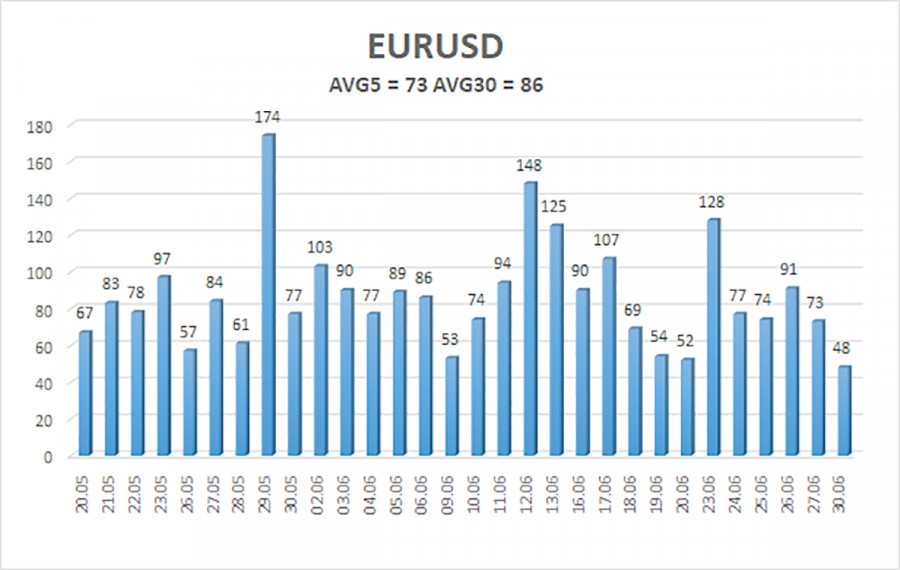

The average volatility of the EUR/USD pair over the last five trading days as of July 1 is 73 pips, which is classified as "moderate." On Tuesday, we expect the pair to move between the levels of 1.1671 and 1.1817. The long-term regression channel is pointing upward, indicating a still-bullish trend. The CCI indicator has entered the overbought zone, but this has triggered only a slight downward correction again. Currently, the indicator is forming bearish divergences, which in the context of an uptrend merely suggest a possible correction.

Nearest Support Levels:

S1 – 1.1719

S2 – 1.1597

S3 – 1.1475

Nearest Resistance Levels:

R1 – 1.1841

R2 – 1.1963

Trading Recommendations:

The EUR/USD pair remains in a bullish trend. The U.S. dollar remains under intense pressure from Trump's policies — both foreign and domestic. Furthermore, the market interprets many data releases negatively for the dollar or ignores them altogether. We continue to observe a complete unwillingness on the part of the market to buy the dollar under any circumstances. If the price drops below the moving average, short positions can be considered, with a target at 1.1475; however, a significant decline is unlikely under current conditions. Above the moving average, long positions remain relevant, with targets at 1.1817 and 1.1841, in line with the continuation of the trend.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.