Trade Review and Trading Tips for the British Pound

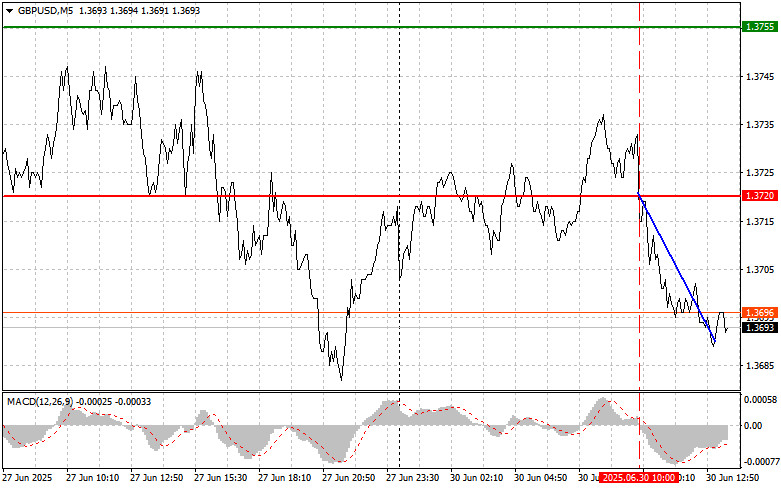

The test of the 1.3720 level coincided with the MACD indicator just beginning to move downward from the zero line. This confirmed the correctness of the sell entry and resulted in a drop of over 35 points for the pair.

UK GDP data for Q1 showed no revisions, which negatively impacted GBP/USD. The absence of upward revisions signals a lack of positive momentum in the economy needed to support the British currency. Market participants had likely expected more optimistic results that could suggest recovery following a period of economic instability. A significant decline in investment volumes in Q1 also weighed on GDP and the pound. Reduced investment activity is concerning, as it may reflect declining business confidence and expectations for profitability. Investors likely fear that lower investment could lead to a slowdown in future economic growth. Thus, the combination of flat GDP and a sharp drop in investment has created an unfavorable backdrop for the British currency.

Today's economic calendar is filled with events that may influence market sentiment. The Chicago PMI, which reflects regional business activity, will be in the spotlight. Analysts and investors closely watch this indicator, as it can provide insight into the broader economic outlook. Equally important will be speeches by FOMC members Raphael Bostic and Austan D. Goolsbee. Their remarks on the current economic environment and monetary policy outlook could significantly shape market expectations. Of particular interest will be their assessment of the latest U.S. inflation data, which came in line with forecasts. The market will be watching to see whether these Fed officials believe inflation is on a steady path toward the 2% target. If they express confidence, expectations for a sooner policy easing may strengthen. Conversely, if they emphasize ongoing inflation risks, the market may reassess the timing of future rate cuts.

As for the intraday strategy, I will mainly rely on scenarios #1 and #2.

Buy Signal

Scenario #1:Today, I plan to buy the pound at around 1.3714 (green line on the chart), targeting a rise to 1.3799 (thick green line). I will exit long positions at 1.3799 and consider reversing into short trades, aiming for a 30–35 point correction from that level. A rise in GBP may occur after weak economic data.Important: Before buying, make sure the MACD indicator is above the zero line and just starting to rise from it.

Scenario #2:I also plan to buy the pound after two consecutive tests of the 1.3679 level, provided the MACD is in the oversold zone. This would limit the pair's downward potential and trigger a reversal to the upside. I expect a rise back to 1.3714 and 1.3799.

Sell Signal

Scenario #1:I plan to sell the pound after the price breaks below 1.3679 (red line on the chart), which should lead to a quick decline. The key target for sellers will be 1.3616, where I will exit short trades and consider reversing into longs (20–25 point correction expected from this level). Sellers are likely to be active if strong economic data is released.Important: Before selling, make sure the MACD indicator is below the zero line and just starting to fall from it.

Scenario #2:I also plan to sell the pound after two consecutive tests of 1.3714, provided the MACD is in the overbought zone. This would limit the pair's upward potential and trigger a downward reversal. In this case, a decline toward 1.3679 and 1.3616 can be expected.

Chart Notes:

- Thin green line – suggested entry point for long positions;

- Thick green line – approximate Take Profit level or manual exit level; further growth is unlikely above it;

- Thin red line – suggested entry point for short positions;

- Thick red line – approximate Take Profit level or manual exit level; further decline is unlikely below it;

- MACD Indicator – for entries, rely on identifying overbought or oversold conditions.

Important: Beginner traders on the Forex market should make entry decisions with caution. It's best to stay out of the market before major fundamental releases to avoid being caught in sharp price swings. If you do trade during news events, always use stop-loss orders to minimize potential losses. Without stop-losses, you risk losing your entire deposit very quickly, especially if you trade large volumes without proper money management.

And remember, successful trading requires a clear trading plan, like the one outlined above. Making spontaneous decisions based on the current market situation is a losing strategy for any intraday trader.