The GBP/USD currency pair will remain under the influence of geopolitics and politics in the new week. Essentially, we've been saying the same thing every day for the past four months: all movements in the foreign exchange market are directly tied to Donald Trump's actions, decisions, and plans. It's only been four months since Trump became president, and look at how many global events have occurred!

It's not just about the trade war that Trump has unleashed against China and 74 other countries. One can also point to the Republican's inability to resolve the conflict between Ukraine and Russia, even though he, as a U.S. presidential candidate, had promised to do so "within 24 hours." Trump likely believed that his authority gave him enough leverage over Vladimir Putin and Volodymyr Zelensky to convince them to end the conflict. In practice, however, he had no influence on the two presidents of the warring nations. So, Trump turned to his favorite tool—threats. He said that if Kyiv refused to engage in peace talks, he would freeze all aid to Ukraine. If Russia refused peace, he would impose a new sanctions package on Moscow and introduce a 500% tariff on all countries importing energy resources from Russia. As one might expect, these measures also failed to produce significant results.

There's also the "One big, beautiful bill" that Trump is eager to pass. Almost all experts have called this bill "disastrous" for the U.S. economy, as it entails cutting support for the poor and vulnerable segments of the population while lowering taxes... mainly for the wealthy and well-off. Trump has also proposed making tips tax-exempt. Many experts, including Elon Musk, have stated that this new law would increase the U.S. national debt by another 3 trillion dollars. Let us recall that Trump had promised to reduce the national debt.

And the conflict between Iran and Israel, which has taken on new dimensions under Trump, is the cherry on top. The leader of the Republican Party, who promised to end many wars and styled himself as a peacemaker deserving of a Nobel Prize, has effectively admitted that the White House is behind the attacks on Iran, which refuses to abandon uranium enrichment and nuclear weapons development. Trump is now giving Iran a chance to resume negotiations, but it's clear that Tehran will not abandon its long-standing policy (which has remained unchanged for decades despite sweeping sanctions) just because Washington wants it to. Thus, it seems a new war in the Middle East involving the U.S. is on the horizon.

We believe that none of Trump's promises have been fulfilled. The conflict in Ukraine continues, and a new conflict has begun in the Middle East (likely with Biden also to blame). No trade deals have been signed, and the U.S. economy contracted in the first quarter under the new president. Meanwhile, the market continues to flee from the dollar and the U.S. as far as possible. It also largely ignores factors that would otherwise support the American currency occasionally.

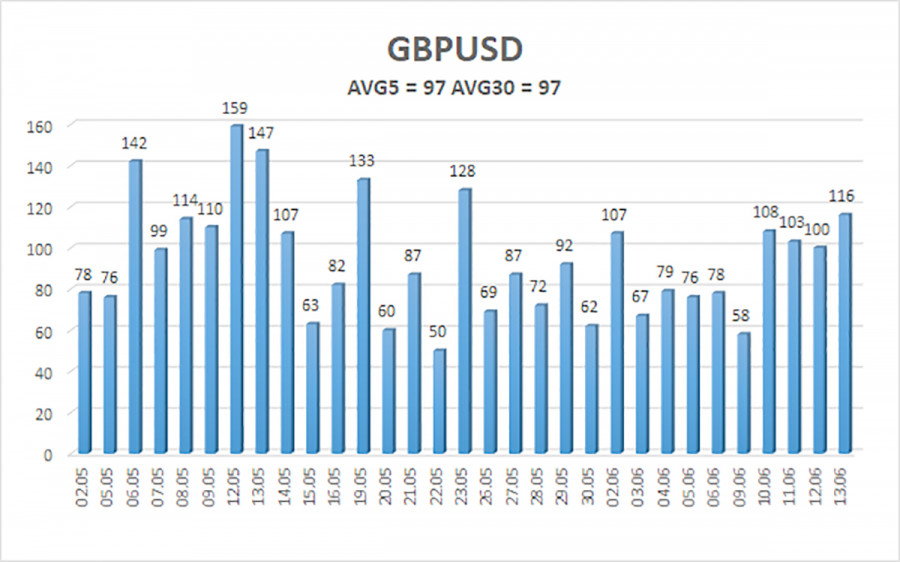

The average volatility of the GBP/USD pair over the past five trading days is 97 pips, which is considered "moderate." Therefore, on Monday, June 16, we expect movement between 1.3473 and 1.3667. The long-term regression channel is pointing upward, indicating a clear uptrend. The CCI indicator has not recently entered extreme zones.

Nearest Support Levels:

S1 – 1.3550

S2 – 1.3489

S3 – 1.3428

Nearest Resistance Levels:

R1 – 1.3611

R2 – 1.3672

R3 – 1.3733

Trading Recommendations:

The GBP/USD pair maintains its upward trend and continues to rise. And there is no shortage of news supporting such a move. Each new decision by Trump is met with hostility by the market, while positive news from the U.S. is in short supply. Thus, long positions targeting 1.3672 and 1.3733 are much more relevant if the price remains above the moving average. Consolidation below the moving average would allow for considering short positions targeting 1.3489 and 1.3428, but the probability of growth is significantly higher than that of decline. From time to time, the U.S. dollar may show slight corrections. We need real signs of ending the global trade war for more substantial growth.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.