The EUR/USD currency pair continued its upward movement on Wednesday. The U.S. dollar has been falling steadily for over a week—something that hasn't happened in over a month. However, every fairytale comes to an end. We've repeatedly stated that the problem with the U.S. currency and the American economy is no longer the global trade war but rather the very figure of Donald Trump as President. Of course, we could be wrong to make such a bold statement, but the market clearly answers how it feels about the Republicans' policies.

Just as traders had barely started to digest Trump's tariff measures, the U.S. President began pushing his second "brainchild." This time it's the so-called "One Big Beautiful Bill Act," which is being promoted as a tax cut law. In reality, this bill includes many provisions, most of which either work against American citizens and their incomes or have nothing to do with taxes.

The bill proposes to significantly restrict access to social assistance. For example, under the Medicaid program, applicants must work at least 80 hours per week. Remember, this is a healthcare assistance program for low-income individuals. The bill also envisions increased defense spending, $350 million for deporting illegal migrants, repeals tax credits for green energy, eliminates taxes on overtime and tips, and increases the maximum amount for tax deductions.

Trump presented this bill by stating that taxes would be cut. However, many questioned how he planned to address the budget deficit if tax revenues decreased. Tax cuts = reduced budget revenue. It's now becoming clear that Trump aims to pass a bill that appears to lower some taxes while simultaneously slashing or eliminating various tax credits, social benefits, and funding for social programs. In other words, Americans, not China or the EU, will foot the bill for Trump's tariffs. By lowering some taxes, Trump plans to recoup the funds by cutting social programs and tax reliefs. What did you expect? Money doesn't appear out of thin air (unless you're the Federal Reserve). If it disappears somewhere, it has to come from somewhere else.

But American voters might rejoice because their country has embarked on a bright path to a "great future." America will soon be great again—without illegal immigrants, or immigrants at all, as American factories fly their equipment back home, taxes fall, global wars end, and the U.S. trades fairly with everyone. Of course, this is sarcasm. The market may have been fooled eight years ago; it may have been fooled in early 2025. But today, when faced with whether to buy or sell the dollar, the answer is obvious.

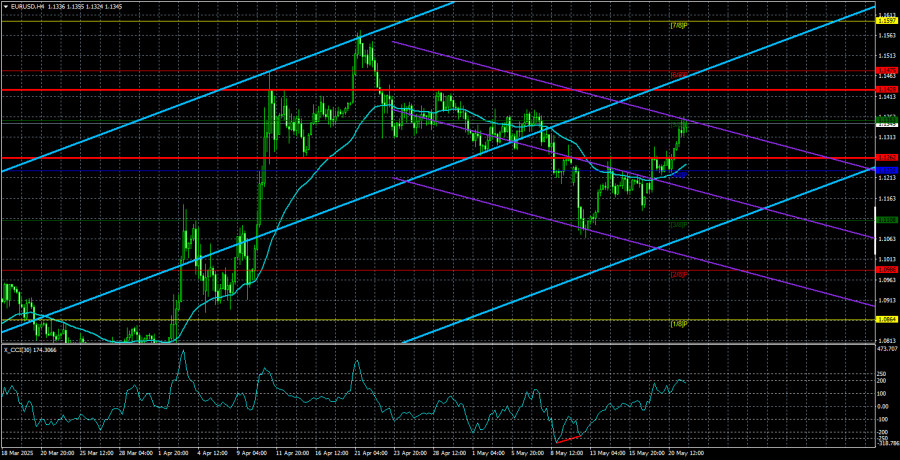

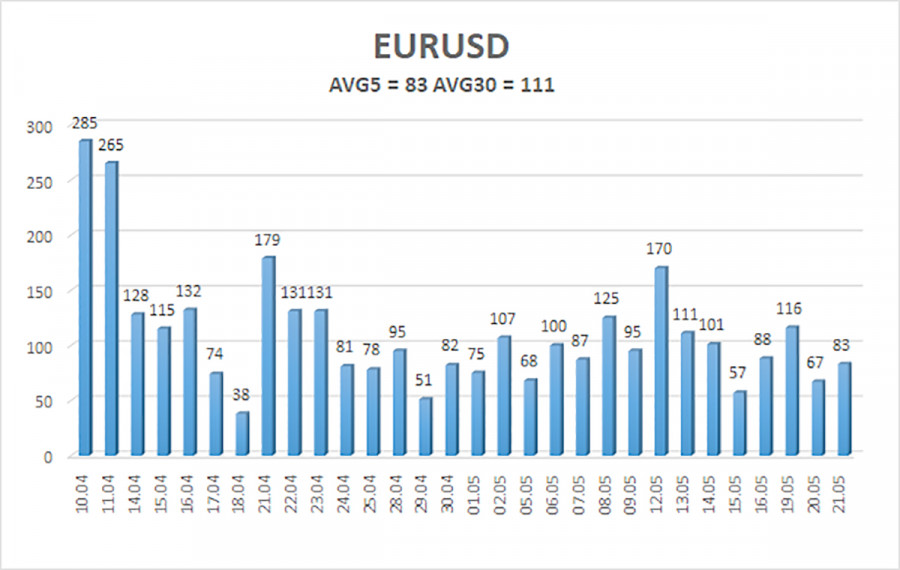

As of May 22, the EUR/USD pair's average volatility over the last five trading days is 83 pips, which is characterized as "moderate." We expect the pair to move between the levels of 1.1262 and 1.1428 on Thursday. The long-term regression channel is directed upward, indicating a short-term upward trend. The CCI indicator entered the oversold area, which, on an uptrend, signals trend resumption. A bit later, a bullish divergence formed, triggering a new upward wave.

Nearest Support Levels:

S1 – 1.1230

S2 – 1.1108

S3 – 1.0986

Nearest Resistance Levels:

R1 – 1.1353

R2 – 1.1475

R3 – 1.1597

Trading Recommendations:

The EUR/USD pair is attempting to resume its upward trend. For months, we've consistently stated that we expect only a medium-term decline in the euro, and nothing has changed in that regard. The dollar still has no reason to fall, except for Donald Trump's policies. The U.S. President has recently pushed for a trade truce, so the trade war factor might support the dollar. Nonetheless, the market continues to show a complete reluctance to buy the dollar, which now appears more like a personal protest against Trump. If the price is below the moving average, shorts remain relevant with targets at 1.1108 and 1.0986. Long positions with targets at 1.1428 and 1.1475 can be considered if the price is above the moving average.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.