Markets on Edge: Investors Brace for Sell-Off After US Strike on Iran

Financial markets are on alert this Monday as investors anticipate a sharp downturn following a US military strike on Iran over the weekend. The potential for retaliation and a surge in oil prices is weighing heavily on global sentiment.

Middle East Tensions Eclipse Economic Reports

The escalating crisis in the Middle East has overtaken the release of US economic data as the primary focus for investors. The unexpected move by President Donald Trump to back Israel's military campaign against Iran has heightened concerns over market volatility, inflation trends, and the Federal Reserve's next steps on interest rates.

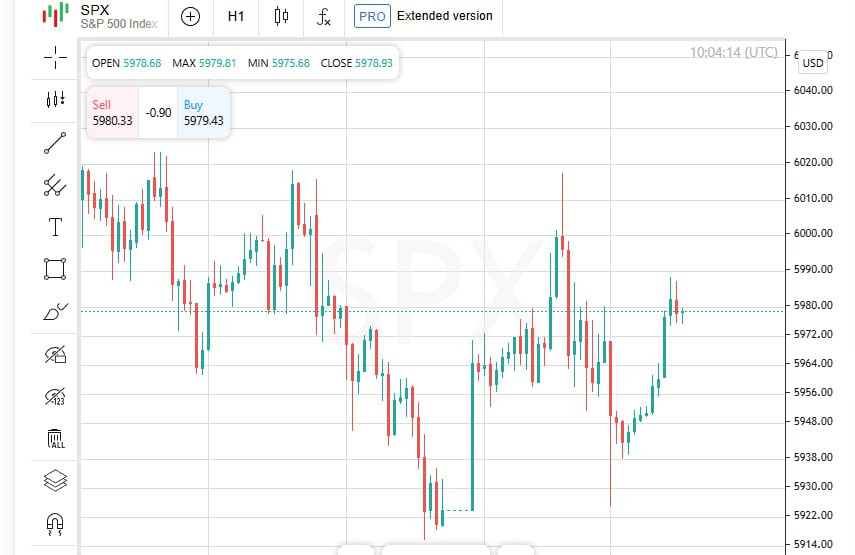

S&P 500 Stalls Below Record Highs

The S&P 500 index, while rebounding from early April losses, remains approximately 2.7 percent below its February peak. Despite nearing the 5 percent threshold from its previous high over the past 27 trading sessions, it has yet to reach a new record.

Oil Prices Climb, Markets Hold Their Breath

The growing conflict between Israel and Iran has already driven oil prices higher. Though equities have remained relatively stable so far, market participants remain wary. A sustained rise in energy prices could fuel inflation and disrupt the Fed's expected path toward interest rate cuts.

Fed Holds Rates Steady, But Leaves the Door Open to Cuts

During its Wednesday meeting, the US Federal Reserve kept interest rates unchanged. Policymakers signaled that borrowing costs could still decline later this year, though the expected pace of rate cuts is likely to be slower than projected in March. Officials pointed to anticipated inflationary pressure, potentially fueled by President Donald Trump's tariff plans, as a reason for the revised outlook.

A Data-Heavy Week Ahead for US Markets

Investors are bracing for a flood of key economic reports. Monday brings updates on US business activity and home sales. Consumer confidence figures are set for release on Tuesday, followed by Friday's PCE price index, the Fed's preferred measure of inflation.

Consumers Cautious, But Sentiment May Be Rebounding

US consumer confidence has dipped in recent months amid fears that tariffs could push the economy toward recession and stoke inflation. However, with inflation remaining tame and the US-China trade conflict showing signs of de-escalation, market participants are hoping for a rebound in household sentiment.

European Stocks Struggle for Direction Amid Middle East Escalation

European markets opened the week with mixed performance, as rising geopolitical tensions weighed on investor mood. The joint US-Israeli strikes on Iran's nuclear facilities over the weekend introduced fresh uncertainty into an already fragile global landscape.

Key European Indices:

- STOXX 600: down 0.01 percent to 536.57 points;

- Germany (DAX): down 0.1 percent;

- France (CAC 40): down 0.1 percent;

- Spain (IBEX): up 0.1 percent;

- United Kingdom (FTSE): up 0.04 percent.

Deadline Nears: Trade Talks Falter as Tariff Expiry Looms

With the July 8 deadline to lift US tariffs approaching, negotiations with Washington appear to have stalled. Hopes for a breakthrough are fading, adding to market uncertainty.

Eurozone Growth Stalls Again in June

Economic momentum across the eurozone remained stagnant for the second consecutive month. According to a report released Monday, the service sector — typically the driving force of the region's economy — showed only modest improvement. Meanwhile, manufacturing activity registered no change at all.

UK Sees Modest Rebound in Business Activity

In contrast, the United Kingdom posted a slight uptick in business activity for June, offering a tentative sign that the domestic economy may be stabilizing.

Tech and Energy Lead Market Gains

Technology stocks led the advance across European markets, climbing 0.6 percent. The energy sector followed with a 0.3 percent gain, fueled by rising oil prices amid renewed concerns over supply disruptions following strikes on Iranian facilities.

Defense Sector Under Pressure

Shares in the European aerospace and defense industry declined by 0.9 percent, as investor sentiment shifted in light of escalating tensions and market volatility.

Corporate Headlines: Mergers, Divestitures, and Clinical Results

- Spectris soared by 14.9 percent after private equity firm Advent announced its intention to acquire the scientific instruments manufacturer in a deal valued at 4.4 billion pounds;

- Holcim gained 11.1 percent after the Swiss construction materials giant completed the spin-off of its North American division, Amrize, marking a key step in its restructuring strategy;

- Novo Nordisk declined by 2.8 percent following the release of full results from late-stage clinical trials of its experimental weight-loss drug, CagriSema. Despite reaching this advanced phase, the market's reaction was tepid;

- UCB advanced 4.4 percent after Morgan Stanley upgraded the Belgian biopharmaceutical company's rating from "equal weight" to "overweight," citing improved growth prospects